Filing for COVID-19 unemployment benefits in New York - Copy

Overview of unemployment benefits under COVID-19

Legal disclaimer: The information presented in this overview is provided for informational purposes only and should not be construed as legal advice on any subject matter. You should not act or refrain from acting on the basis of any content included in this overview without seeking legal or other professional advice. The contents of this overview contain general information and may not reflect current legal developments or address your situation. We disclaim all liability for actions you take or fail to take based on any content in this overview.

This document is work in progress as the UI filing procedure during the COVID-19 has been changing practically on a weekly basis. This document will be updated based on any confirmed changes. The current version is of May 20. Please direct your questions to the NY Department of Labor.

Many of the positive changes that have taken place in the unemployment filing procedure in March and April are due to the activist work and the petition that was started by a group of unemployed New York citizens. The petition is available here. Please consider signing if you agree with the #waivethecall motion.

First step: Determining your eligibility

- There are three types of unemployment assistance during the COVID-19:

- Regular unemployment benefits (UI) extended by additional 13 weeks

- Pandemic unemployment assistance (PUA) based on earnings such as 1099, to be paid for up to 39 weeks

- Additional $600 Pandemic Unemployment Compensation (PUC) a week for all claimants affected by COVID-19 from April 5th till July 31, 2020

Regarding the Economic Impact Payment (the stimulus check), use the IRS tracking tool to track your payment. There is nothing else to do.

What is PUA? Pandemic Unemployment Assistance (PUA) provides payments to workers not traditionally eligible for unemployment benefits. Not only self-employed, but also workers with limited work history, people who are taking care of family members affected by COVID-19, and several other categories who are unable to work as a direct result of the coronavirus public health emergency.

If you had a traditional employment where your employer provided you with a W2 form, you may be eligible for UI plus for up to 39 weeks AND the additional $600 PUC a week until July 31, 2020. So, until July 31, 2020 you may receive UI + $600, and after July 31 - the UI until 39 weeks end.

If you were self-employed and reported your earnings (and paid taxes) based on the 1099 form, you may be eligible for earnings-based PUA for up to 39 weeks AND the additional $600 PUC a week until July 31, 2020. So, until July 31, 2020 you may receive PUA + $600, and after July 31 - the UI until 39 weeks end.

If you were neither employed traditionally or self-employed but you need assistance because you were affected by COVID-19, e.g. your young children's daycare was closed and you are unable to seek employment because you have to stay home with them, you may be eligible for the PUC of $600 a week until July 31, 2020.

- UI is afforded based on W2 earnings and from the state taxes withheld from your earnings. In most cases, your UI claim will be paid by the state where the qualifying earnings occurred in the base period. What it means is that if you reside in New York but was employed in another state, e.g. NJ or CT, in 2018-2019, for two quarters or longer, you might qualify for UI in that state instead of NY. It is very important to establish in which state you qualify, because each state sees your earnings from the place of employment in that state, and the state that does not see sufficient earnings in that state may deny your claim. The maximum UI benefits in NJ and CT are higher than in NY (capped at $504 a week in NY, $649 in CT, $681 in NJ).

- To be eligible for the regular UI in NY, you must meet the minimum earnings requirement in the base period. The Basic Base Period is the first four of the last five calendar quarters before the quarter in which you lost your job. However, if you haven’t made enough earnings in the Basic Base Period, you can ask for the Alternate Base Period instead, which is the last four calendar quarters before the quarter in which you lost your job.

For example, if you lost your job in March 2020, your Basic Base Period is October 2018 through September 2019. Your Alternate Base Period is January 2019 through December 2019.

To qualify for UI, you must have:

- Earned at least $2,600 a quarter in at least two quarters of the base period

- Earned a total of at least 1.5 times the highest quarter of the base period in the entire base period. For example, if your highest quarter earnings were $5,000, you must have earned at least $7,500 in the entire base period.

This document describes the minimum earnings requirement very well.

On this page you will be able to check your eligibility based on the minimum earnings and compute the likely benefit amount you will be getting.

To be eligible for the regular UI in NY, you must have lost your job for no fault of yours: the employer must have terminated your employment as a lay-off, did not renew your contract for no fault of yours etc. You cannot claim UI if you voluntarily quit your job.

To be eligible for PUA, you must first be found ineligible for UI.In NY, you must first file a claim for NY and be either denied or found ineligible, and then you can claim PUA.Update: As of April 20, self-employed individuals can file for PUA without filing for UI first, or you can file concurrently. You can file the PUA claim on the same day after you file for UI, without waiting for a decision on the UI. If you are self-employed and know you would not qualify for the regular UI, you can use the new application on the NY.gov website to file for PUA right away.

This checklist is used in NY to determine eligibility for PUA. Notice that PUA is intended for people specifically affected by COVID-19. Freelancers qualify as “self-employed/independent contractors/1099 filers” and/or “otherwise not qualified for regular or extended UI benefits”.

People who qualify for regular UI will also receive $600 a week on top of their UI benefits. They do not need to apply for PUC separately if their UI claim is approved.

Second step: Filing for unemployment assistance

This overview will specifically describe the steps for filing in New York.

- To file a new claim, visit https://unemployment.labor.ny.gov/login. The form will help you determine whether you should file for UI or PUA.

- If you have an existing claim that you need to reopen or if you already filed for UI and want to file for PUA, visit this page.

The login is the same as what is used across all state systems in NY. If you have ever used NY DMV services online or applied for any state certifications (e.g. teaching) or benefits (Medicaid, SNAP), you have an existing login. If you are not sure, use “Forgot your Username or Password” feature. You don’t want to create a duplicate NY.gov ID. If you are having difficulties accessing your NY.gov account, there are two numbers to call: 866-789-4638 or 800-833-3000. This page has helpful tips about NY.gov ID. If you are certain you don’t have an existing NY.gov ID, use “Create NY.gov Account” on the main page.

- On the main page of My Online Services you might see various error messages in yellowish boxes, like the one below. It is currently normal.

- Fill out the UI application. Be very careful: the answer to the question whether you are able and available to work is YES. Even though most of us are not able to work on sites because of the quarantine, the automatic system will reject your claim if you say you are NOT able and available.

- If you are self-employed:

- The answer to "How many employers have you worked for in the past 18 months" is "One employer". Leave "The Federal Employer Identification Number (FEIN)" and "New York State Employer Identification Number (ER Number)" blank. In "Last Employer Name" type "Self-employed". In "Address" and "Employer's telephone number" enter your office or residential contacts.

- The answer to Question #5 in Eligibility Information, "Other than part-time work, on-call work, or owning a single-family rental unit, do you have a business or are you engaged in any activity which brings in or may bring in income?" is "No".

- There is currently a broad variety of scenarios what happens after you submit the claim. You might be told that your claim is completed, and you are now required to certify weekly. It does not mean that you will be receiving UI benefits because a completed claim sometimes means $0 benefit. But you are required to certify weekly. On the weekday corresponding to your last name (you will see instructions in the confirmation) you will need to either visit the labor.ny.gov website or call a dedicated line with automated prompts to confirm that you are still not employed and are still able and available to work (remember, the answer is YES!)

- If you are asked to fax over your 1099, W2, Schedule C or other documents and you don't have a fax machine, there are several options:

- Use online fax services to fax your documents to 1-518-457-9378 or 5184579378@fax.ny.gov. Try RingCentral Fax or MyFax (they have free options or a free trial). Write your SSN on top of every page (unless it's already there).

- Upload online using Messages on NY.gov website.

- Mail to NYS Dept of Labor, PO Box 15130, Albany, NY 12212-5130. How to mail without going to a post office: calculate the postage, attach stamps on the envelope, and either put it in your mailbox if you have a mailbox that the mailman opens or drop in in a blue USPS box on the street. You can even request USPS to pick up your mailing.

- You will be asked to choose if you want to taxes to be withdrawn from your unemployment benefits. UI and PUA benefits are taxable at the federal, state, and local level (like income). The applicable federal income tax in New York is 10%, and the state income tax is 2.5%. If you choose not to withhold taxes, you will receive the full amount but will need to include it as income in your next tax declaration and pay taxes at the end of the year.

- If you are filling out the direct deposit information and get an error that "Make sure that you have entered your Mother's Maiden Name correctly", it is a known glitch. Try to enter the name either in all capital letters or in all lower case.

You might see a message that your claim is incomplete, and you must call the call center to complete it. Do not call. DoL has implemented the procedure where DoL associates call incomplete claims within 72 hours. If you try to call, you will likely experience very long wait times (an hour or longer).

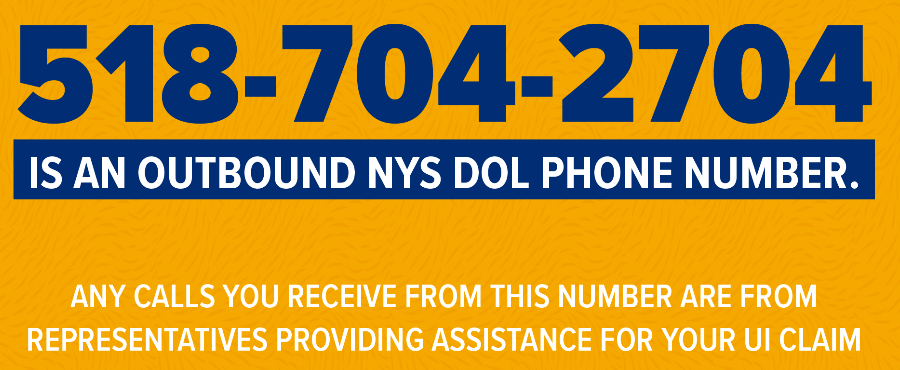

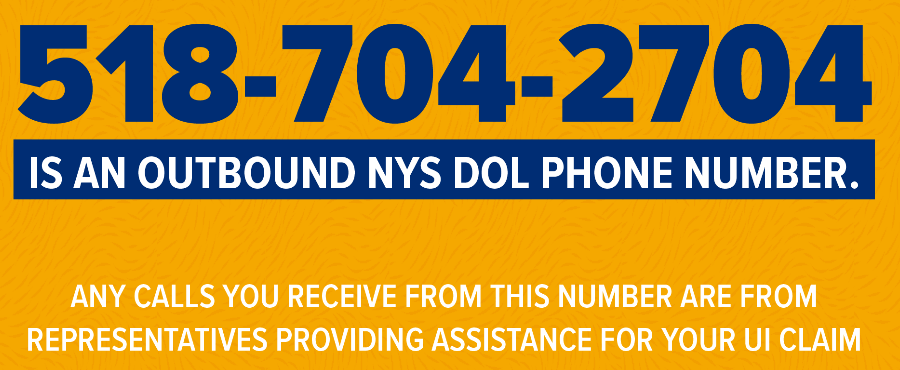

Callback comes from this number: 518-704-2704. Beware of scams!!! DoL associates will tell you the date of your filing and the type of the claim. If you receive a call from another code, it might be a scam. The associates will ask for your full SSN and your mother’s maiden name, but first they will prove to you they are from DoL with the information above.

Why you might be denied or found ineligible for UI (which is entirely normal and is the green light to apply for PUA): you were not employed in a traditional sense on a W2; your earnings in two or more quarters of the base period were insufficient; you earned money outside NY and NY state does not have information about it, therefore they assume you did not earn enough.

You will likely receive a message from DoL within 24 hours of filing that you might be eligible to apply for PUA. Do most certainly apply.

- How to apply for PUA:

Go to https://unemployment.labor.ny.gov/login. Start a new application, which will determine whether you should pursue UI or PUA.

Be careful to show that one of the options from the PUA eligibility checklist does apply to you. If you choose to qualify as “self-employed/independent contractors/1099 filers”, you will be asked to upload your 1099 forms.

The claims of freelancers who upload 1099 forms will be assessed to compute an analog of UI benefits based on their 1099 earnings. $600 will be added to that amount. E.g. if DoL establishes that your 1099 earnings were enough to earn you $130 in UI benefits, you will be receiving two payments a week: $130 and $600. If you did not earn enough, you will be receiving $600. $600 will only be paid till July 31, 2020.

After submitting the PUA application, it should show in Online Forms as Completed and Pending. It will likely remain pending until there is a decision on your UI application.

Be careful, you are not done yet. Under Unemployment Insurance, click the Unemployment Services button. You will need to choose where the money goes.

*There are unfortunate cases where applicants won’t be able to use Unemployment Services because their UI claims stay incomplete until they speak to a DoL associate. If you see such a message on the Unemployment Services page, you need to wait for a callback from DoL. Wait for 72 hours. Callback comes from this number: 518-704-2704. Beware of scams!!! DoL associates will tell you the date of your filing and the type of the claim. If you receive a call from another code, it might be a scam. The associates will ask for your full SSN and your mother’s maiden name, but first they will prove to you they are from DoL with the information above.

Normally under Unemployment Services you will see:

Inquire about your payment history – information about the amount you are eligible to receive, the effective date and how many weeks remain on the claim.

Update your personal information – this is where you can register for a direct deposit to your bank account. This is very important. There is a shortage of debit cards, and people who opted for a debit card instead of a direct deposit may have to wait for a card to be mailed.

Even if you set up direct deposit, it is known that it might happen that NY.gov would still issue you a debit card and deposit your first payment on it. It may take 7-10 days from the date the claim is processed for the debit card to reach you. Several states such as Connecticut report longer times. The debit card is issued by Keybank.

This page has answers to various questions about the debit card.

Get your NYS 1099-G – that is just to download a template 1099 if you need it.

After the claim is approved

After your claim shows under Unemployment Services as effective (you will see the effective date, how many days are left on the claim, and the amount of benefits), you must begin weekly certification even if the claim is pending. This is very important. You will only be paid for the weeks that you certified for. Put a weekly reminder on your calendar if you want to be certain you won't forget. You must certify every week, even if you had a paid project, even if you were out of the state (in which case you may not be eligible for that week's benefits).

With the backlog of claims under review, it may take weeks before claims move to payment. You must certify weekly during this time.

Certification can be done either online, under Unemployment Services, or by phone, 888-581-5812 (regular UI or PUA) or 833-324-0366 (PUA only).

This document explains how to answer the certification questions. Remember: the answer to the question whether you are able and available to work is YES even during the pandemic.

Additional information

- Normally, after filing for UI, people are not paid for the first week (called a waiting week). Under the COVID-19, the waiting week is waived. You will be paid retroactively for every week starting from the day you became eligible for UI beginning January 27, 2020.

- If you recently claimed UI and exhausted 26 weeks at any time after July 1, 2019, you can reopen your claim and receive additional 13 weeks.

- If your employer brought you back, but only part-time, you may still be eligible to receive PUC of $600. Source.

- If you need assistance other than UI to stay safe and healthy, there are various resources that may help:

- Find if you are eligible for SNAP (Supplemental Nutrition Assistance Program) - electronic food coupons for low-income working people, senior citizens, the disabled and other eligible categories.

- Find the local food bank.

- There are medical insurance options for unemployed: explore here.

- Emotional support line for people experiencing stress and anxiety over the COVID-19 crisis: call 844-863-9314, 8 am to 10 pm 7 days a week.

- Federal Mental Health line: call 866-615-6464, 8:30 am to 5 pm Monday through Friday.

- Suicide prevention helpline: call 800-273-8255 any time or visit https://suicidepreventionlifeline.org. You are not alone. It is very hard right now and it may really hurt. Please call for help.