4 Fun Ways Parents Can Teach Kids About Investing

Myelle Lansat, Grow.Acorns.com

Parents: When you’re teaching your kids about important financial topics like saving and debt, don’t forget about investing, too.

About two-thirds of adults with kids say their parents taught them about saving, but only 22% said their parents taught them about investing, according to a recent Creditcards.com survey. The site polled 2,964 parents with children under 18.

To start, Rossman suggests showing kids a comparison chart that illustrates the advantages of starting to invest at a young age and remaining invested over time.

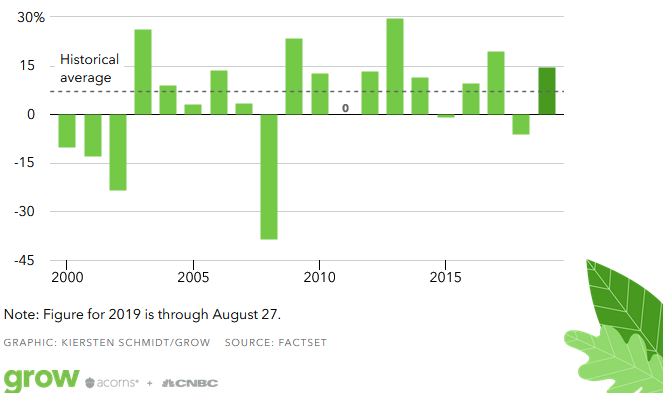

Annual Return

So far in 2019, the S&P 500 is experiencing above-average growth.

When you’re ready to talk to your children about investing, here’s how to make the subject more appealing to kids of all ages.

1. Start with spending and earning basics

It’s important for young children to understand the value of a dollar before teaching them about investing, says Douglas Boneparth, a certified financial planner and the founder of Bone Fide Wealth in New York City. Start off with the basics, he says: Money is earned by working, which then can be saved, spent, or invested.

Then, you can explain to your kids what bills and expenses are — for example, your internet connection works because you pay a provider for service. Once children have this basic understanding, they’ll have an easier time grasping what it means to invest and be a partial owner in a company, he says.

2. Play games about risk and reward

A disciplined investor is looking to be rewarded over time, rather than make a quick buck, says Boneparth. He suggests playing a game that illustrates the way rewards work over the long-term: Tell your child they can have a piece of candy at lunch time, or if they wait until after dinner, they can receive two pieces of candy. “You’re teaching them that patience can earn you a greater reward over time,” he says. Although, he adds, “I think 9 out of 10 times they’ll say ‘give it to me now.’”

Typically, it can take years to see the average stock market return of almost 10%, which means investors need to take the long view about the market’s ups and downs. Showing kids how patience pays off is a valuable investing lesson, says Boneparth.

You’re teaching them that patience can earn you a greater reward over time.

3. Create an investment portfolio

Tracking a portfolio can easily open the door to a conversation about what it means when stocks rise and fall, and how that impacts your initial investment, Rossman says. It’s something kids can enjoy even at a young age: Ariel Community Academy in Chicago gives each of its first grade classes an investment portfolio worth $20,000.

Mock portfolios are an easy intro, and can be tied to your child’s interests. If he likes cars, for instance, you can create a basic mock investment portfolio that includes individual stocks of auto companies like Tesla, Ford Motor Co., Nissan, BMW, and General Motors, to name a few. Then, have your kid choose how much “money” to invest in each stock and let the market take it from there.

Ready for the real deal? “Using real money can be a tremendous lesson for kids, if you can make it engaging,” Rossman says. You can open a custodial brokerage account or custodial IRA for your child where you can gift shares or invest allowance money. You’ll have control of the account to invest on your child’s behalf until your child turns 18 or 21, depending on state laws.

When you’re teaching children about investing, Rossman says not be too hard on kids if mistakes happen. Instead, seize on opportunities to teach them valuable investing lessons. He says that even if your child’s modest portfolio loses money, that’s an opportunity to teach the valuable lesson of staying positive, even when the market fluctuates.